Spot Ethereum ETFs could gain momentum as the SEC is seeking public comments on several proposals. This move signals a potential shift in regulatory approach, possibly paving the way for these long-awaited investment vehicles in the cryptocurrency world.

Let’s dive into what this news means for the crypto market, how Ethereum ETFs work, and their potential impact on crypto trading volume.

Understanding Ethereum ETFs

An Ethereum ETF is an investment vehicle that tracks the price of ETH, the native cryptocurrency of the Ethereum blockchain.

Ethereum ETFs give investors more exposure to Ethereum without needing to handle the intricacies of buying, storing, and managing the digital asset itself.

ETFs operate like traditional stocks, are traded on exchanges, and provide investors with an accessible and regulated entry point into the cryptocurrency market. Spot Ethereum ETFs hold ETH directly, while others may use futures contracts linked to ETH’s price. Ultimately, ETFs offer an attractive entry path for institutional investors and those new to the crypto sector.

The Evolving Crypto-ETF Regulatory Landscape

The decisions made by the SEC in the past indicate that they have concerns regarding the manipulation of cryptocurrency markets and the protection of investors.

However, the approval of spot Bitcoin ETFs in January 2024 was a turning point, potentially leading to a similar green light for spot Ethereum ETFs. Experts believe that if Bitcoin, as a widely traded digital asset, received the SEC’s nod for a spot ETF, the likelihood of a spot Ethereum ETF receiving the same treatment is solid.

Impact on Crypto Trading Volume and Cryptocurrency Market

Many people in the cryptocurrency community believe that the introduction of Ethereum Exchange-Traded Funds (ETFs) would have a positive impact on the market.

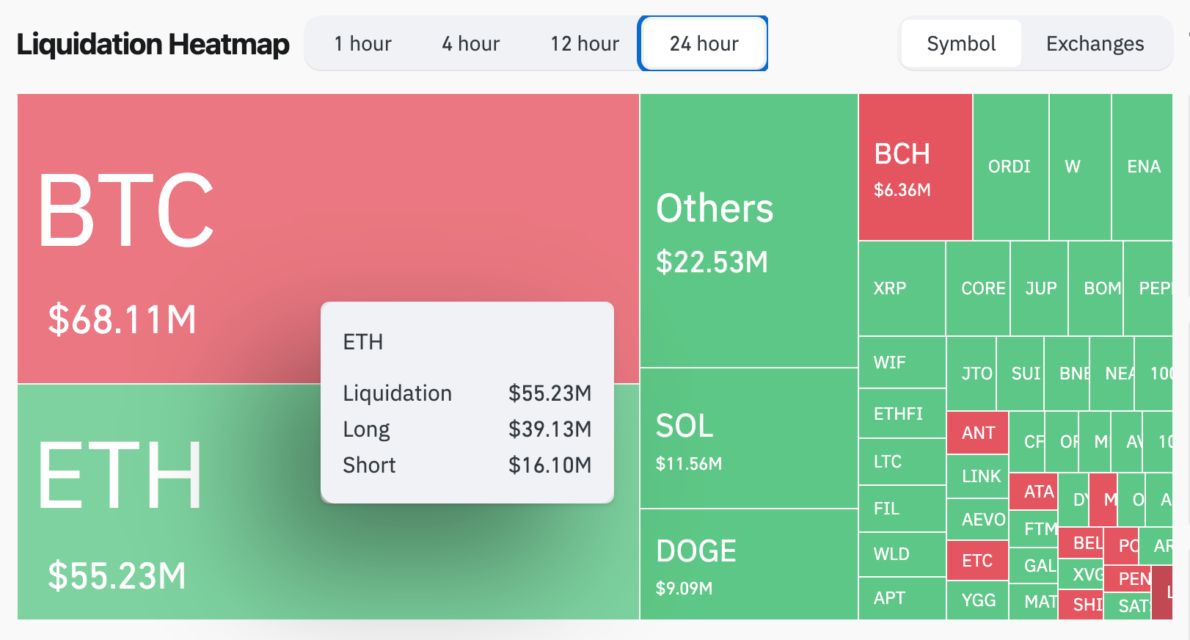

These ETFs have the potential to unlock a surge of new investor capital, significantly impacting the trading volume of cryptocurrencies, particularly Ethereum (ETH), and ultimately affecting the crypto market.

As institutional investors continue to show increasing interest in digital assets, the introduction of spot Ethereum ETFs could serve as a gateway to broader adoption and mainstream acceptance of cryptocurrencies.

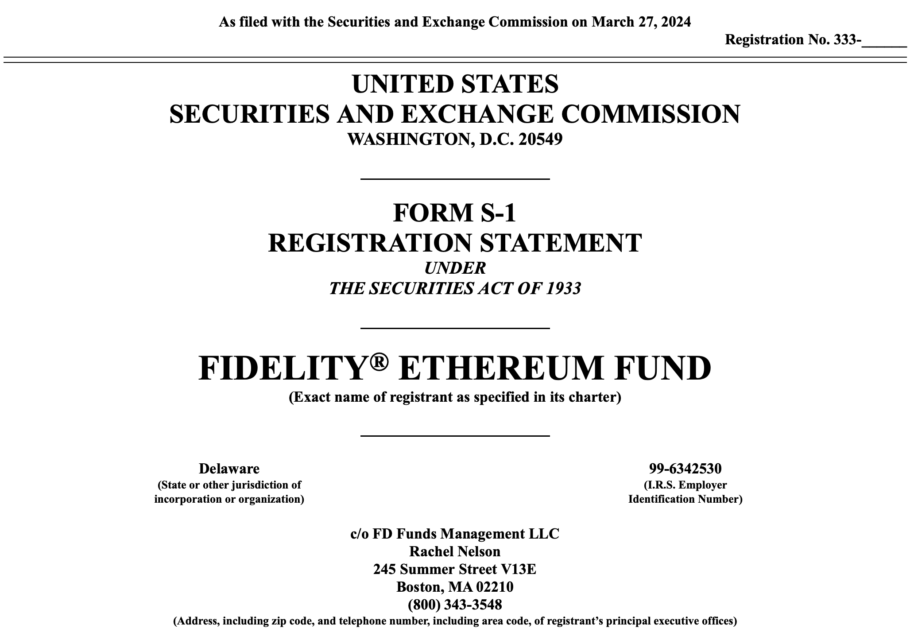

The SEC’s recent request for public comments on proposed Ethereum ETFs from major industry players like Fidelity, Grayscale, and Bitwise marks a crucial juncture.

This decision shows the agency’s desire to develop a more profound knowledge of the market sentiment before making a final approval decision.

ETFs as a Gateway to the Crypto Market and Impact on Ethereum’s Price and Market

Exchange-traded funds offer a user-friendly and regulated way to invest in cryptocurrencies. Their inherent accessibility and ease of use could entice new investors into the market, thereby increasing crypto trading volume and potentially aiding market stabilization.

The approval of spot Ethereum ETFs would undoubtedly lead to increased liquidity and institutional investment within the Ethereum network.

With the market size of Ethereum measuring about a third of Bitcoin’s, a spot Ethereum ETF would likely result in an even more significant price impact for Ether than we might have seen with Bitcoin.

This surge in demand and increased adoption could lead to a positive price upswing, contributing to further innovation and development within the Ethereum ecosystem.

What the Future Holds for Crypto ETFs with the Spot Ethereum ETFs

One hurdle remains in the SEC’s classification of Ethereum. Is it a security or a commodity?

This distinction plays a vital role in the approval process. Still, the agency signaled evolving views on the crypto markets by approving select Bitcoin ETFs. This precedent offers optimism for the eventual approval of Ethereum ETFs.

Success for spot Ethereum ETFs could create a path for other cryptocurrencies to follow suit. Increased investor demand for a diversified portfolio of digital assets could translate into a significant influx of capital into the cryptocurrency space.

Experts predict that in the third year after the launch of a spot Ethereum ETF, we could see a massive $39 trillion inflow of new investments.

The SEC’s interest in public opinion regarding Ethereum ETF applications points to a potential shift in the regulatory treatment of cryptocurrencies. Spot Ethereum ETFs have the potential to increase market participation by allowing a broader range of investors to access the market, increasing liquidity, and potentially driving ETH’s price and long-term market stability.

As the regulatory framework develops, it will be paramount for investors to remain informed. This collaborative approach between participants and regulators will ensure investor protection while nurturing innovation within the crypto space.

Question for Readers: How do you see the approval of spot Ethereum ETFs shaping the broader cryptocurrency market?