The world’s largest asset manager, has caused a stir in the cryptocurrency world with its proposed Blackrock Bitcoin ETF (Exchange-Traded Fund) added five new companies as authorized participants.

The arrival of these new participants in the ETF has been seen as a bullish indicator for the price of Bitcoin. The ETF, which has accumulated over 260,000 BTC since its launch in January 2023, has become a major player in the crypto sector1. The addition of these new participants has also helped the ETF surpass $10 billion in assets faster than any other US ETF in history

A regulated and streamlined way for investors to gain exposure to Bitcoin, this ETF holds the potential to reshape the crypto landscape.

BlackRock Bitcoin ETF: A Shift in Institutional Sentiment

BlackRock’s interest in Bitcoin signals a potential sea change in how traditional financial institutions view cryptocurrencies. Here’s why this matters:

- Validation: BlackRock, a titan of the investment world, pursuing a Bitcoin ETF lends significant credibility to Bitcoin as an asset class. This development could potentially inspire other major organizations to consider investing in cryptocurrency.

- Accessibility: A regulated Bitcoin ETF removes hurdles for institutional investors who may hesitate to navigate the complexities of directly buying and storing cryptocurrency. It paves the way for more extensive capital inflows.

- Evolving Perceptions: BlackRock’s actions challenge the long-held skepticism within traditional finance toward cryptocurrencies. The firm’s evolving stance reflects a growing recognition of Bitcoin’s potential for long-term value and its role in a diversified portfolio.

- Partnership with Coinbase: In 2022, BlackRock’s partnership with Coinbase, a major cryptocurrency exchange, further solidified its commitment to offering Bitcoin exposure to its clients. This strategic move strengthens their position within the emerging crypto investment landscape.

Lingering Considerations

While BlackRock’s Bitcoin ETF represents a significant step, it’s important to remember:

- Regulatory Hurdles: The approval process for a spot Bitcoin ETF in the US remains uncertain, and regulatory challenges may still lie ahead.

- Market Volatility: Bitcoin, like other cryptocurrencies, is known for price volatility. This risk factor remains present despite the potential benefits of a regulated ETF.

The entire repercussions of this move remain to be seen in the future, but it represents an increasing acknowledgment of Bitcoin’s significance in the shifting investment environment.

Pros and Cons of BlackRock’s Bitcoin ETF

Pros:

- Convenient, Regulated Access: BlackRock’s ETF offers a familiar and regulated way to gain exposure to Bitcoin. Investors can trade the ETF on traditional stock exchanges, eliminating the need to set up a cryptocurrency wallet or navigate complex exchanges. This ease of access can attract new investors who might have hesitated to enter the crypto market directly.

- Diversification: Bitcoin can act as a hedge against inflation and traditional market downturns due to its limited supply and lack of correlation with other asset classes. Including a Bitcoin ETF in a portfolio can offer diversification benefits, potentially reducing overall portfolio risk.

- Price Tracking: The ETF allows investors to track the price movements of Bitcoin within the framework of established financial markets, helps to ensure transparency, and eliminates the need to monitor multiple cryptocurrency exchanges separately.

- Potential for Lower Fees: While ETFs typically have management fees, BlackRock’s scale and reputation could lead to a competitively priced ETF compared to other options. Lower fees would improve overall returns for investors.

Cons:

- Management Fees: As mentioned earlier, ETFs have fees that eat into returns. Investors should consider these fees when comparing the ETF’s performance to the underlying asset (Bitcoin).

- Loss of Direct Control: ETF investors don’t directly own Bitcoin but hold shares that represent it. They have no control over Bitcoin and are subject to the custodian’s security measures.

- Centralization Concerns: Some argue that Bitcoin ETFs could contribute to the centralization of the Bitcoin network. If a limited number of large institutions hold a significant portion of the ETF, it could concentrate control and potentially go against the decentralized philosophy behind Bitcoin.

Additional Considerations:

- Tracking Error: A potential drawback of ETFs is tracking error, which occurs when the ETF’s performance deviates from the underlying asset. Investors should understand how BlackRock’s ETF is structured and how closely it tracks the price of Bitcoin.

- Tax Implications: Tax regulations on cryptocurrency can be complex. Investors should research the tax implications of investing in a Bitcoin ETF in their country’s jurisdiction.

- Bitcoin’s Immaturity: The cryptocurrency market is still relatively young, and Bitcoin, like other cryptocurrencies, is a volatile asset, meaning that Investors should be comfortable with a higher degree of risk before considering a Bitcoin ETF.

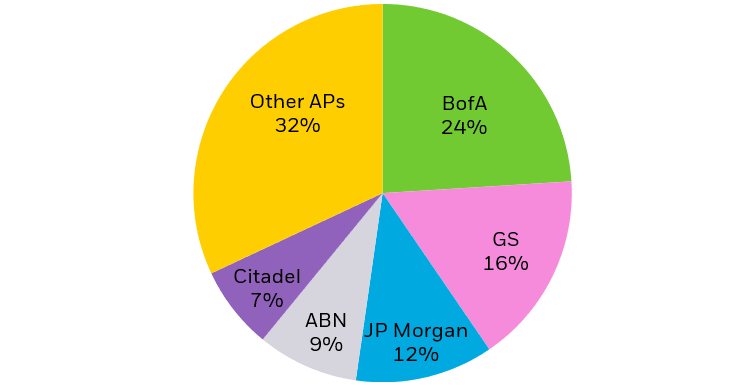

The Crucial Role of Authorized Participants: Market Makers of the Bitcoin ETF

Authorized Participants (APs) are the backbone of the ETF ecosystem, and their role is particularly vital in a Bitcoin ETF. Essentially, these APs, which are typically large financial institutions, are responsible for:

- Creation and Redemption: APs have an exclusive agreement with BlackRock, allowing them to create new ETF shares when demand is high and redeem existing shares when supply outpaces demand. This mechanism helps maintain the balance between the ETF’s share price and the underlying value of the Bitcoin it represents.

- Liquidity: APs inject liquidity into the market, ensuring smooth trading of the ETF and preventing large price swings due to imbalances in supply and demand.

- Arbitrage Opportunities: APs closely monitor the ETF’s price about the value of its Bitcoin holdings. If discrepancies arise, they can exploit these pricing gaps through arbitrage, ensuring the ETF’s price stays aligned with Bitcoin’s market value.

Who’s Involved: BlackRock’s Authorized Participants

BlackRock has enlisted reputable and well-established financial institutions as APs for its Bitcoin ETF. These include:

- Goldman Sachs

- Citigroup

- UBS

- Citadel Securities

- ABN AMRO

- Jane Street Capital

- JPMorgan

- Macquarie

- Virtu Americas

The Significance of BlackRock’s Bitcoin ETF

The involvement of these established financial giants as authorized participants lends credibility and stability to BlackRock’s Bitcoin ETF. It signals institutional confidence in the ETF’s structure and their willingness to participate in the cryptocurrency market in a regulated manner, potentially leading to an increase in the overall investor interest in the ETF.

Potential Impact of BlackRock’s Bitcoin ETF on the Crypto Market

BlackRock’s Bitcoin ETF could have substantial effects on the cryptocurrency market:

- Increased Adoption: Simplifying the investment process might attract new capital and boost Bitcoin’s adoption.

- Enhanced Liquidity: The ETF could improve liquidity within the Bitcoin market.

- Regulatory Scrutiny: An approved ETF might accelerate regulatory oversight of the crypto space.

- Market Volatility: ETF-driven demand could contribute to price fluctuations in the short term.

BlackRock’s Bitcoin ETF: A Catalyst for Change

BlackRock’s proposed Bitcoin ETF signals a potential watershed moment for the cryptocurrency industry.

It could usher in a new era of broader adoption and institutional investment. However, as with any investment, it’s crucial for individuals to carefully assess the potential benefits and risks before making decisions.

The involvement of authorized participants and BlackRock’s entry into the crypto space will significantly impact the market’s evolution.

Whether investing in BlackRock’s Bitcoin ETF aligns with your personal risk tolerance and investment strategy is a decision that requires careful deliberation.