Pressure for Pakistan to regulate cryptocurrency market grows after a report of 221 million inhabitants that states that the Pakistanis own more cryptos than the Country’s own FIAT reserves.

A study by the Federation of Pakistani Chambers of Commerce and Industry (FPCCI) revealed that Pakistanis own $20 billion in cryptocurrencies.

This amount exceeds the Country’s international reserve, valued at 18 billion dollars which brings us back to the use of Bitcoin as part of international reservations by countries, just as El Salvador is doing.

After all, with each new dollar printing, for example, all countries with USD lose purchasing power.

Finally, the FPCCI report recommends how Pakistan should act concerning cryptocurrencies, which are not yet regulated.

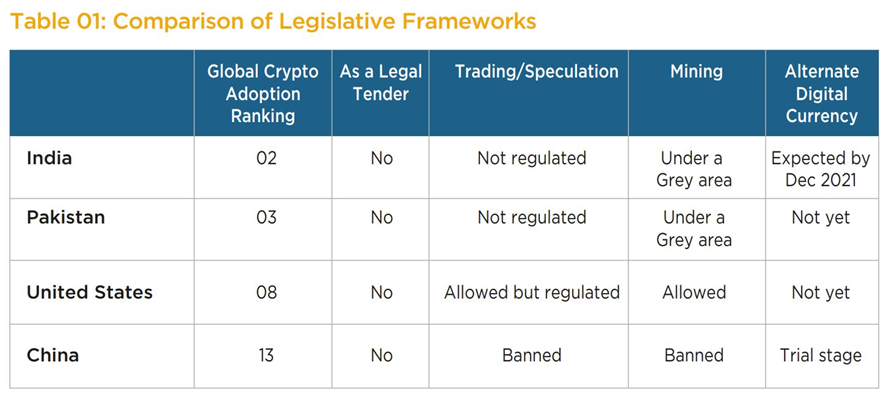

For example, the document cites the US, China, and India, each with a different mindset.

More cryptos with the population, less fiat coins in international reserve

The latest report by the Central Bank of Pakistan (SBP), published on December 17, 2021, points out that the Bank has 18 billion dollars in international reserves. That is, in other currencies like the Dollar and Euro.

But the report of the Federation of Chambers of Commerce and Industry of Pakistan (FPCCI) shows that Pakistanis have $ 20 billion in cryptocurrency.

The Pakistani Rupee (PKR) has already lost more than 45% of its value against the dollar (USD) since 2013. Since January 2021, the drop has been 9.73%. Bitcoin (BTC), on the other end, has gained 64% against the USD in the same period.

Although it is already being used as a store of value by many people and even large companies like Tesla and MicroStrategy, El Salvador is the only Country with reserves in Bitcoin.

Despite this, it is possible to imagine other countries’ digital currencies used, such as Bitcoin.

Central banks will have Bitcoin as a store of value, according to Alex Krüger.

Alex Krüger, a famous cryptocurrency trader and founder of Aike Capital, believes that central banks worldwide will buy Bitcoin and store value with digital assets.

In a series of tweets, he compared banks’ demand for gold and how they will inevitably have to have digital currency as a reserve asset.

According to the graph shared by Krüger, BCs’ demand for gold soared by more than $30 billion in 2012; however, it dropped by $16 billion in 2020.

The economist shows that the central banks’ loose monetary policies made gold stay more expensive.

With a clear view of the appetite that central banks have for gold, Krüger uses the numbers to illustrate the possible demand by central banks for Bitcoin.

The economist believes that $1.2 billion would be just the beginning. He expects the number to increase after a first central bank buys bitcoin as a reserve asset.

Pakistan wants to regulate cryptocurrency market.

The most vital point of the document issued by the FPCCI is to expose the need to regulate the cryptomarket.

After all, 20 billion dollars worth of cryptocurrencies is a considerable amount for a country of 221 million people.

As an example of countries to be followed, the report points out the posture of three other countries concerning cryptocurrencies.

Among them are China and India, the most populous countries globally, and the USA, a world power that is more open to cryptos.

The table shows the differences between these countries and how creating their CBDCs is going. While China has banned trading and mining cryptocurrencies, the US allows both activities.

India and Pakistan are halfway there, even though they are two countries among the three with the highest adoption of cryptocurrencies.

On the digital coins of central banks, CBDCs, Pakistan, and the US are still not so motivated to launch them. China and India are in more advanced stages of digitizing their currencies.

Finally, the report recommends that Pakistan follow the advice of the International Monetary Fund (IMF) and the International Financial Action Group (FATF) and is separated into three distinct phases.

It cites a cryptocurrency declaration scheme (to collect taxes), expansion of the legislative framework, to create an exchange, launching ETFs, monitoring, and surveillance of transactions, capital control restrictions to non-recognition them as legal tender.