The Internal Revenue Service (IRS) has taken a major step forward in the evolution of taxation of digital assets by releasing a draft of the 2025 Digital Asset Reporting Form for U.S. taxpayers. This initiative is aimed at enhancing compliance and oversight in the rapidly growing digital asset market.

As cryptocurrencies and other digital assets play increasingly prominent roles in the global economy, this new form will be crucial for both taxpayers and the IRS to ensure accurate reporting and fair taxation.

Overview of the 2025 Digital Asset Reporting Form

Dive into the specifics of the IRS’s newly proposed 2025 Digital Asset Reporting Form, designed to streamline the reporting process for all parties involved in digital asset transactions. We will cover the motivations behind the form, its expected impact, and the key details that taxpayers need to know.

More info here:

https://www.federalregister.gov/d/2023-17565

Key Features of the New Form

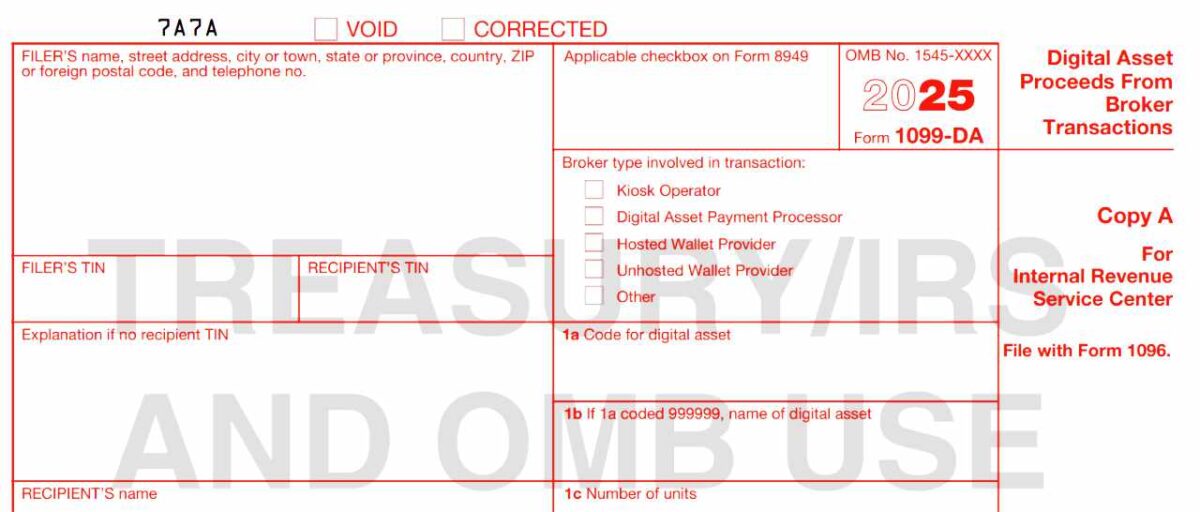

The upcoming Digital Asset Reporting Form, the Form 1099-DA, is a response to the increasing integration of digital assets like cryptocurrencies, NFTs, and stablecoins into the mainstream financial ecosystem.

Set to be introduced by the IRS for use in 2025, this form represents a pivotal shift towards standardizing the reporting of digital asset transactions, aligning them more closely with traditional financial reporting mechanisms.

What will be reported on Form 1099-DA?

Form 1099-DA will provide information about the sale or dispose of digital assets. The IRS defines this as cryptocurrencies, NFTs, and stablecoins.

Form 1099-DA will report the same information that is already reported on Form 1099-B for stocks:

- When you received the digital asset (acquisition date)

- How much did you pay for it (cost basis)

- When you sold or swapped it (sale or disposal date)

- How much money you made by selling or swapping it (sales proceeds)

- Gross proceeds (total proceeds from that exchange or broker, without taking cost basis into consideration)

- This will apply to sales made after January 1, 2025, therefore you will receive your first 1099-DA form in January 2026.

Scope and Reporting Requirements:

Under the new regulations, brokers and other intermediaries will be required to report transactions involving digital assets using the Form 1099-DA. This form will capture essential data such as the taxpayer’s name, address, tax identification number, and the gross proceeds from the sale of digital assets.

Significantly, it will also include the adjusted basis of the assets sold, allowing for a more accurate calculation of capital gains or losses.

Standardization of Reporting:

The Form 1099-DA is designed to replace various forms previously used to report digital transactions, such as Forms 1099-B, 1099-K, and 1099-MISC.

This consolidation aims to reduce confusion and improve the accuracy of reported data. The form will facilitate the IRS’s ability to track and tax digital transactions more effectively, mirroring the compliance levels seen with traditional securities.

Privacy and Compliance Challenges:

The introduction of Form 1099-DA also raises questions about privacy due to the required reporting of sensitive information such as wallet addresses and blockchain transaction IDs.

Brokers will need to navigate these requirements carefully to protect client information while complying with IRS directives.

Implementation Timeline of the DA-1099 Form:

Brokers must start reporting transactions using the Form 1099-DA for sales of digital assets that occur on or after January 1, 2025. This gives financial institutions and taxpayers time to prepare for the changes, although the final regulations are yet to be issued.

The IRS is currently soliciting comments and feedback on these proposed regulations, indicating that adjustments could still be made based on stakeholder input.

These changes underscore the IRS’s commitment to closing the tax gap associated with digital assets by bringing transparency to this rapidly evolving sector. Both taxpayers and brokers should prepare for significant changes in how digital asset transactions are reported, with an eye towards compliance by the 2025 deadline.

Who Needs to File the DA-1099 Form?

The Form 1099-DA is specifically designed for brokers and other intermediaries who facilitate the sale and exchange of digital assets. These entities are responsible for collecting and reporting detailed information about transactions to both the IRS and the involved taxpayers.

Individuals and businesses engaging in digital asset transactions through brokers will see these transactions reported on their behalf.

Challenges for Taxpayers:

Taxpayers face several challenges under the new regulations, particularly in terms of compliance and record-keeping.

The requirement to disclose detailed transaction information, including potentially sensitive data like wallet addresses, could raise privacy concerns.

Furthermore, the accuracy of the reported information is crucial as it directly affects tax liability calculations.

Mitigating Compliance Risks:

To mitigate these risks, taxpayers should ensure they maintain thorough records of their digital asset transactions.

This includes tracking the acquisition cost, the date of each transaction, and any exchanges or transfers of assets.

Such meticulous record-keeping will be essential for accurately reporting to the IRS and resolving any discrepancies that may arise from broker-reported data.

Potential Penalties:

Failure to accurately report digital asset transactions can result in substantial penalties. Taxpayers relying on brokerages to report their transactions must verify that all information is complete and accurate to avoid potential legal and financial penalties.

Regular consultation with tax professionals may be advisable to stay compliant with the evolving regulatory landscape.

Final Thoughts and FAQ’s

The release of the IRS Form 1099-DA is a pivotal development in the taxation of digital assets. It reflects the growing recognition of digital assets in the financial system and underscores the IRS’s commitment to ensuring all taxable events are reported and taxed accordingly.

For taxpayers, the form represents both a challenge and an opportunity to align their reporting practices with these new regulatory standards.

FAQs on the 2025 Digital Asset Reporting Form

1. What digital assets qualify for reporting on the new IRS DA-1099 form?

All digital assets that are considered “digital representations of value” and can be recorded on a cryptographically secured distributed ledger qualify for reporting. This includes cryptocurrencies like Bitcoin and Ethereum, stablecoins, and non-fungible tokens (NFTs). The broad scope ensures that any digital asset used in a manner similar to traditional financial instruments is covered.

2. Who is required to fill out the 2025 Digital Asset Reporting Form?

Brokers and other financial intermediaries who facilitate the trading, sale, or exchange of digital assets will need to fill out and file Form 1099-DA. This requirement extends to any entity that acts as a middleman in the digital asset market, providing services that effectuate these transactions.

3. What are the penalties for non-compliance with the new digital asset reporting requirements?

Non-compliance can result in significant penalties, including fines and legal consequences. These penalties are intended to enforce accurate reporting and compliance with tax obligations. The IRS emphasizes the importance of accurate information reporting to reduce the tax gap related to digital asset transactions.

4. How can taxpayers prepare for the transition to the new reporting requirements?

Taxpayers should begin by ensuring they have robust systems for record-keeping that can track purchase dates, costs, and details of every transaction involving digital assets. Engaging with tax professionals who are knowledgeable about digital assets and new IRS regulations can also help in preparing for these changes. Regular updates from IRS guidelines will be crucial as the implementation date approaches.

5. Where can taxpayers find more information and assistance with filling out the form?

Taxpayers can find more information on the IRS website under the digital assets section. Additionally, professional tax advisors familiar with digital asset regulations can provide guidance. Educational resources and webinars are also expected to be available as the implementation date nears, aimed at helping both taxpayers and professionals understand and adapt to the new requirements.

For more specific details or further reading, you might consider checking the official IRS website( IRS.gov) or consulting with tax professionals who specialize in digital assets.