Bitcoin Market dominance has surged to a three-year high, sparking excitement in the cryptocurrency market.

This significant shift for Bitcoin (BTC), the undisputed king of crypto, raises questions about the future of altcoins and the overall direction of the crypto landscape.

Let’s dive into what this means and how investors might navigate this changing market dynamic.

Understanding Bitcoin Market Dominance

Bitcoin domination is the proportion of total cryptocurrency market capitalization owned by Bitcoin.

When Bitcoin’s dominance rises, it generally means that BTC is outperforming other cryptocurrencies, attracting increased investment.

A higher Bitcoin dominance percentage suggests that investors have an increased appetite for the established cryptocurrency market leader.

Recent Surge in Bitcoin Dominance

Several factors are contributing to the recent surge in Bitcoin’s dominance, including:

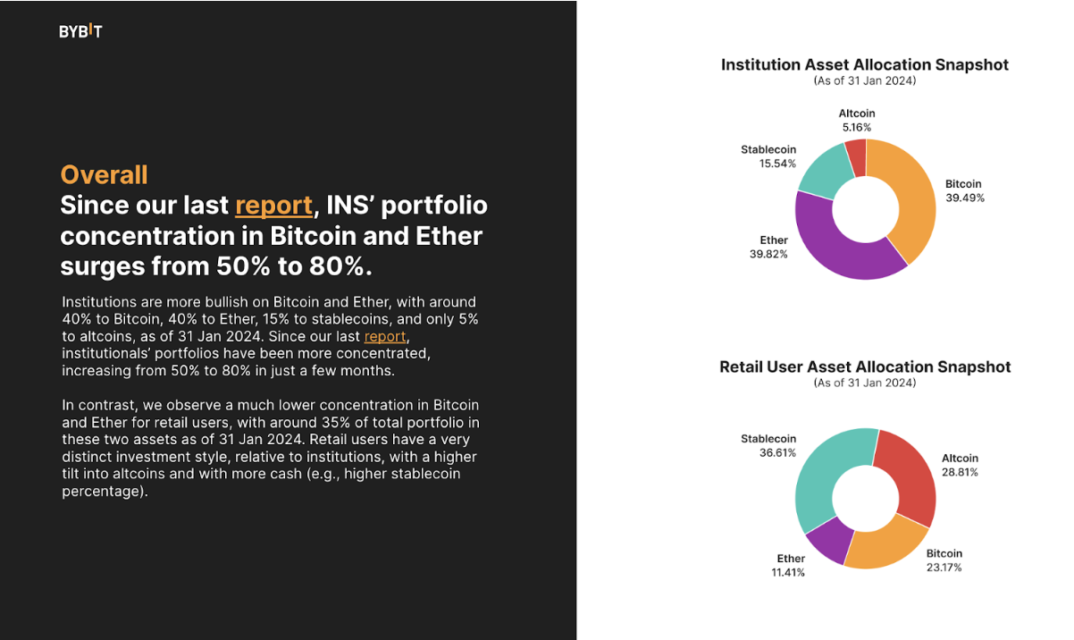

- Increased Institutional Interest: Larger investors often favor Bitcoin due to its established track record and higher perceived stability.

- Regulatory Concerns: Looming regulations within the crypto space may make investors flock towards Bitcoin as a perceived safer haven during uncertainty.

- Altcoin Volatility: Recent fluctuations in altcoin prices may have made the “tried and true” appeal of Bitcoin more enticing.

Market Analyst Opinions: Decoding the Dominance Surge

The recent surge in Bitcoin’s dominance has sparked a lively debate among market analysts, with a range of perspectives emerging:

1. Altcoin Exodus vs. Temporary Trend:

- Bullish on Bitcoin: Some analysts believe this signifies a wider shift away from altcoins. They argue that investors are seeking the perceived safety and stability of Bitcoin, especially with increased institutional interest and regulatory uncertainties. This could lead to a sustained period of Bitcoin dominance.

- Altcoin Resilience Camp: Others see this as a temporary trend. They believe strong altcoins with innovative projects and real-world applications will continue to attract investment in the long run. They point to past instances where altcoin markets have rebounded after periods of Bitcoin dominance.

2. Macroeconomic Factors:

- Flight to Safety: Certain analysts interpret the rise in Bitcoin dominance as a “flight to safety” response to broader economic concerns. Bitcoin, with its limited supply and established presence, might be seen as a hedge against inflation or market volatility.

- Impact of Global Events: Geopolitical tensions or global economic events could be influencing investor behavior, leading them to favor the perceived stability of Bitcoin.

3. The “Maturation” of Crypto:

- Institutional Evolution: Analysts who subscribe to this view suggest that the rise in Bitcoin dominance reflects the maturing crypto market. As institutional investors enter the space, they may favor the established reputation and higher liquidity of Bitcoin, compared to newer altcoins.

4. Divergent Views on Duration:

- Short-Term Dominance: Some analysts believe this is a short-term phenomenon, with altcoins regaining momentum as market dynamics shift.

- Long-Term Restructuring: Others predict a longer-term restructuring of the crypto market, with Bitcoin potentially consolidating its dominance as the primary store-of-value asset within the crypto ecosystem.

Potential Implications for Cryptocurrency Investors

The rise in Bitcoin dominance offers a crucial moment for investors to re-evaluate their crypto strategies.

A focus on diversification is wise, but short-term adjustments to balance a portfolio towards Bitcoin may be beneficial while its dominance holds.

However, it is critical to note that the long-term viability of correctly chosen altcoins, should not be underestimated.

Historical Context of Bitcoin Dominance: Key Takeaways

Bitcoin’s dominance has fluctuated throughout its history due to various factors:

- Early Years (2009-2013): Bitcoin initially held near-total dominance, but the emergence of altcoins began to erode this position.

- Altcoin Explosion (2017): The ICO boom of 2017 saw Bitcoin’s dominance dwindle as investors researched new firms, followed by a market downturn and a partial return to dominance.

- Cycles of Change (2018-Present): Bitcoin dominance has shifted in a cyclical pattern. Periods of Bitcoin outperformance are often followed by “alt seasons” where altcoins experience significant growth.

Important Lessons:

- Market Dynamics: Bitcoin’s dominance is not static; it reflects changing investor preferences and market trends.

- Cyclical Nature: The crypto market operates in cycles. Understanding fluctuations in Bitcoin dominance can aid in future predictions.

- Altcoin Potential: While Bitcoin has a strong track record, some altcoins offer innovation and growth potential, deserving attention from investors.

Studying the past patterns of Bitcoin dominance provides a clearer view of the current market and helps inform smart investment decisions.

Taking Advantage of Bitcoin’s Rise: Strategies for the Current Market

While the future of Bitcoin dominance is uncertain, the current surge offers opportunities for investors to capitalize on this shift. Here are some strategies to consider:

- Dollar-Cost Averaging (DCA) into Bitcoin: DCA involves investing a fixed amount into BTC at regular intervals smoothing out price fluctuations, and potentially reducing risk over time. With Bitcoin’s price on the rise, a consistent DCA strategy could allow for gradual accumulation as dominance remains high.

- Rebalancing Your Portfolio: If Bitcoin’s surge has caused its percentage in your portfolio to grow significantly, consider rebalancing. Sell a portion of the increased BTC holdings and consider redistributing the proceeds into your existing altcoin positions or new, carefully researched projects.

- Exploring Bitcoin-focused Investment Vehicles: The rise in Bitcoin dominance has led to increased access to specialized investment instruments. Consider exchange-traded funds (ETFs) or other products providing indirect exposure to Bitcoin, especially if regulations allow such investments in your region.

- Short-Term Trading: For experienced traders, the current volatility may present short-term opportunities to profit by ‘trading the range’ between Bitcoin and specific altcoins. Use technical analysis cautiously to spot potential entry and exit points.

Important Considerations:

- The Rise of DeFi: The Decentralized Finance (DeFi) sector, built primarily on the Ethereum network, holds immense potential. While Bitcoin dominance is high, strong DeFi projects could still offer significant growth opportunities.

- Staying Informed: The crypto market is highly dynamic. Stay updated on the latest news, regulatory developments, and technological innovations that could impact Bitcoin’s dominance and overall market movement.

Potential Risks of “All In” on Bitcoin

While Bitcoin’s dominance is high, it’s vital to recognize the inherent risks of any investment, even in the most established players. Practicing diversification and risk management will help in maintaining a balanced portfolio.

Is This a “FOMO” Moment? Separating Hype from Rational Investing Ahead of the Bitcoin Halving

The fear of missing out (FOMO) is a powerful emotion that can drive impulsive decisions in any market, especially the volatile world of cryptocurrency. As Bitcoin’s dominance climbs and its next halving approaches, it’s essential to ask whether this is a FOMO-fueled surge or a reflection of rational investor sentiment.

Signs of FOMO Intensified by the Halving:

- Media Frenzy: Sensationalized headlines about Bitcoin’s price gains and the historically positive price impacts of previous halving events may further fuel a sense of urgency in investors.

- Herd Mentality: When investors see others rushing into Bitcoin pre-halving, they may succumb to the fear of being left behind, leading to impulsive buying without thorough consideration.

- Focus Solely on Short-Term Gains: FOMO-driven investors may obsess over the potential for quick profits around the halving, neglecting Bitcoin’s suitability for long-term investment strategies and potentially overpaying for the asset.

Arguments Against Pure FOMO:

- Institutional Interest: Growing investment from large institutions suggests strategic interest in Bitcoin’s scarcity model enforced by the halving, which could support long-term price appreciation.

- Regulatory Environment: Potential regulations can drive investors towards Bitcoin’s relative stability and predictability – particularly important as the halving’s effect on supply becomes tangible.

- Altcoin Innovation: Strong development activity on altcoin projects indicates continued belief in blockchain technology, even while Bitcoin’s halving garners more attention.

Striking a Balance in the Shadow of the Halving

The upcoming Bitcoin halving likely intensifies FOMO-driven behavior. Here’s how investors can navigate this:

- Acknowledge the Power of FOMO: Realize that emotions, heavily influenced by the halving narrative, can impact judgment.

- Focus on Fundamentals: Analyze Bitcoin’s unique supply dynamics, the historical impact of halvings, and how BTC fits into your long-term portfolio.

- Avoid Impulsive Decisions: Don’t let short-term hype overshadow careful research and consideration of your own investment goals and risk tolerance.

Remember, while FOMO might propel short-term market movements around the halving, lasting success in the crypto space often requires research, a calculated approach, and patience, especially in these potentially volatile times.

Bitcoin’s increasing dominance marks a noteworthy change in the cryptocurrency landscape. While its future trajectory is uncertain, this shift underscores the ever-evolving nature of this market. A balanced approach that embraces both the potential of Bitcoin and the long-term promise of select altcoins is likely the most prudent strategy for investors in this dynamic environment.

Disclaimer: Remember, cryptocurrency markets are volatile. Invest only what you can afford to lose, and conduct your research before making any decisions.