The World Economic Forum has published on June 8 a document in which it explains the guidelines that governments should follow to regulate DeFi platforms (Decentralized Finance).

The text, titled Decentralized Finance (DeFi) Policy-Maker Toolkit, notes that DeFi activities “span many areas of financial regulation, including securities, derivatives, exchanges, investment management, bank custody, financial crime, finance. consumer, insurance and risk management ”, among others.

Therefore, a coherent and global strategy by a multidisciplinary entity or team is important, they point out from the body.

“An effective regulatory response for DeFi should include a combination of existing, updated, and new regulation, tailored to current needs,” the publication says. Furthermore, while it clarifies that there is a growing set of laws specific to digital assets, such as the European Union’s Markets in Crypto Assets (MiCA) guide, “many jurisdictions have yet to adopt custom legal frameworks.”

In this sense, the guide highlights that the measures that can be taken include:

- Warnings for users and consumers.

- Application of existing laws.

- Acceptance of regulations by DeFi platforms in exchange for measures to protect them, even if there is no legal obligation to do so.

- Elimination of regulations that are no longer necessary in the context of this activity.

- Obtaining limited licenses.

- Restrictive measures of certain activities in the DeFi sector.

- New licenses that address the risks of the new categories designed for DeFi.

- Issuance of guides with new legal frameworks.

In addition to those named, the World Economic Forum considers the possibility that no measure is necessary to regulate these platforms.

Regarding the tools that governments already have to regulate these platforms, the also known as Davos Forum highlights specialized regulatory units (such as FinHub in the United States), which can share their knowledge with legislators; encouraging the flow of information, for example, through white papers; and regulatory sandboxes, which function as “test boxes” for companies to operate in a limited way and with reduced risks under the new regulations.

Likewise, the early clarification of the simplest cases to solve (to leave more resources to the more complex situations) and the coordination of actions of various government entities are added to this list.

The Implicit Risks of DeFi for the World Economic Forum

Regarding the potential risks involved in the development of these platforms, the aforementioned document distinguishes five types of risks: financial, technical, operational, legal compliance, and emerging. Broadly, the first two categories have to do with the loss of user funds and the failure of the software that supports the transactions, respectively.

Meanwhile, operational risks are linked to human errors related to development and governance, while those of legal compliance refers to the potential use of these platforms for criminal activities or evasion of tax obligations. The last type of risks, emerging ones, are linked to problems in the financial macro system due to the integration of DeFi components.

This pronunciation of the World Economic Forum is one more step on the path of regulation of digital service providers, mainly those related to cryptocurrencies. In this sense, the publication of the new guidelines of the International Financial Action Task Force (FATF) on digital assets and decentralized finance is also expected in June.

These new recommendations include the requirement to comply with KYC regulations ( Know Your Customer, which means “Know Your Customer” in English) by these service providers. In addition, from a certain amount, it will be mandatory to identify the operators participating in a transaction.

Is it possible to regulate DeFi?

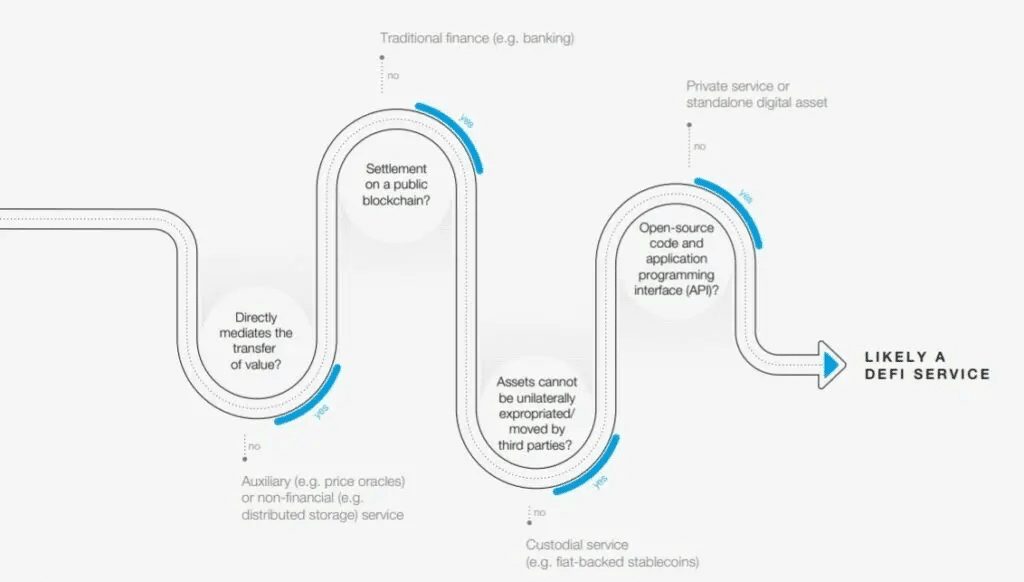

These factors raise the question of whether decentralized platforms can ever be regulated, or if the rules for the crypto industry set by the Financial Actions Task Force (FATF), the global anti-money laundering watchdog, are robust enough.

FATF only covers centralized systems or virtual assets service providers such as cryptocurrency exchanges. These are licensed businesses that allow customers to trade crypto or digital currencies for other assets, such as fiat currencies like the pound sterling, US dollars, and euros.

Such exchanges must adhere to FATF’s “know your customer” requirements, where the platforms are expected to know the parties transacting on them. FATF requirements do not cover financial activities occurring on decentralized systems.

The idea of regulating centralized platforms and cryptocurrency exchanges – where people purchase crypto to use to transact on DeFi platforms, but leaving DeFi platforms unregulated – limits the overall effectiveness of the regulation of the whole crypto industry.

Although it is not impossible to shut off a decentralised system, it is very difficult to achieve and it would require heavy reliance on government or regulatory authorities. It would also require getting access to IP addresses, cooperating with local internet service providers, identifying or tracing the physical location of people using the system and using the police to effectively shut down such platforms or activities. Locating and then prosecuting anyone within one jurisdiction would not be an easy task.

Although this would potentially deter people from using these services and slow down the number of people using them for illegal means, it would be difficult to achieve on a global scale – which would threaten international standards.

It is worth noting that DeFi has been built mainly on the Ethereum blockchain, just as initial coin offerings (ICOs) were in 2017. ICOs eventually fizzled out due to their links with fraud. Whatever its future, DeFi is a fast-growing industry and deserves urgent regulatory attention.