Ethereum price surpasses US$3000 and grows more than 5% in the last 24 hours. The weekly advance exceeds 23%. Ethereum surpasses the US$3000 barrier and is yet to reach the all-time high of more than US$4,000 achieved in May.

The price of ether (ETH), the cryptocurrency of Ethereum, surpassed US$3,000 on August 7, a value that it had not reached since last May.

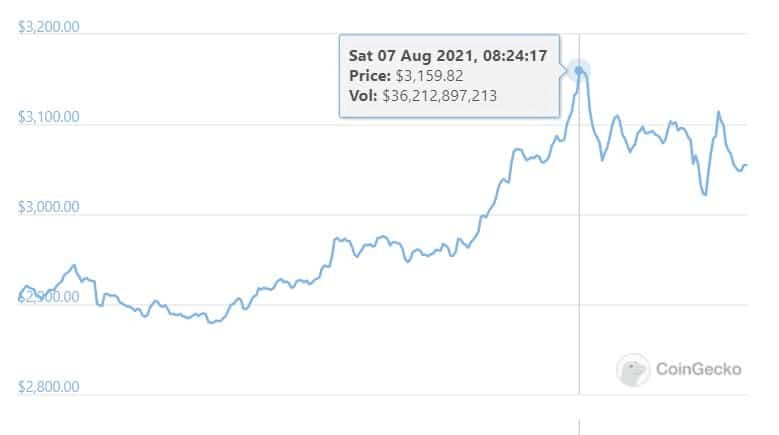

According to CoinGecko data, the price of ETH reached US$3,159 in the first hours of this Saturday, registering a rise of more than 5% in the last 24 hours. The uptrend brings the average weekly growth to more than 23% .

As seen in the price chart, the growth of the cryptocurrency has been sustained since the activation of the London update, a hard fork of the network that occurred on August 5, as reported by CriptoDeFinance.

It is thus established that London is one of the main reasons for this price increase, although, in general, the entire cryptocurrency market is currently in the green.

The hard fork incorporated into the network one of the most anticipated improvement proposals by the community around this cryptocurrency: the EIP-1559.

With this solution, the mechanism by which fees are paid to miners was modified, by introducing the concept of “tip” and adding the burning of commissions. It is expected that with this the currency will become deflationary and that the amount of the commissions will fall.

It is a change that may materialize in the long term, as has been explained in this publication. In this sense, the Ethereum Foundation considers that the collaboration of the wallets will be essential for the improvement proposal to reduce the fees paid on the network.

Commission burning began on August 6. In the immediate aftermath, as a result of the update, around 10,340 ethers have been destroyed, which is equivalent to about US$31.5 million, Etherscan figures indicate .

ETHereum price surpasses US$3000, but still does not exceed its all-time high

Although at this price ether is still far from the all-time high of more than US$4,300 established on May 11 of this year, in the last three months it had not exceeded US$3,000.

The cryptocurrency has been below that amount since May 19, when the entire crypto market fell – along with bitcoin – in a downward trend that lasted until a week ago.

The prolonged market crash was related to the decision by Elon Musk’s electric car company Tesla to stop accepting bitcoin. This, together with the uncertainty generated due to the repression of miners and the obstacles to the commercialization of cryptocurrencies imposed by the Chinese government.

As a result of this news, Bitcoin and Ethereum equally lost more than 50% of their value, having surpassed several all-time highs throughout the first months of 2021.