The bitcoin price fall comes amid gestures of support by various Latino politicians and Latin American legislators, following the announcement by Salvadoran President Nayib Bukele that he will promote the adoption of Bitcoin as legal tender.

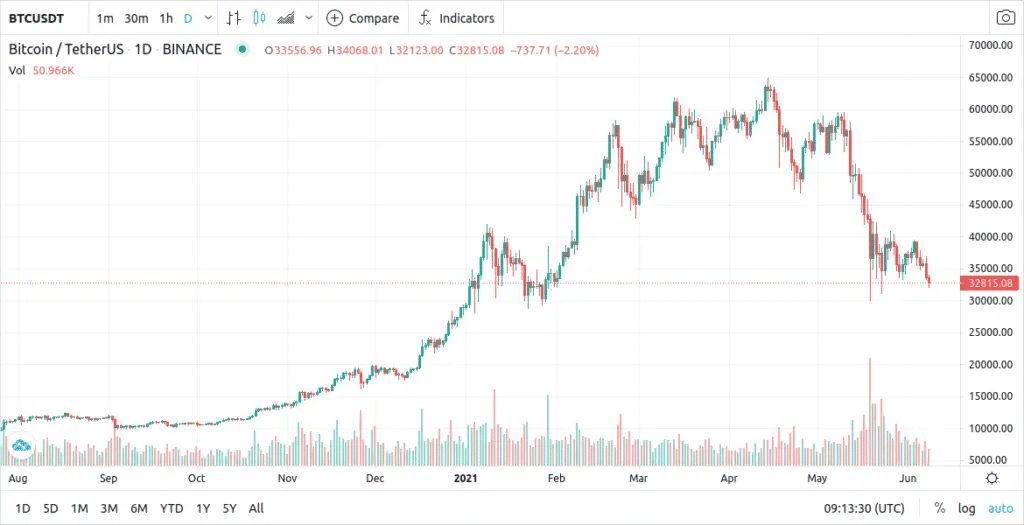

The price of bitcoin marked a new lower low at the June 8 open, sliding 9% in 24 hours. After having closed yesterday at US$33,552 per bitcoin, breaking the demand zone that had been established at US$34,500, today the market opens with bearish movements, even reaching a low of US$32,123.

The fall comes amid gestures of support by various Latin American legislators, following the announcement by Salvadoran President Nayib Bukele that he will promote the adoption of Bitcoin as legal tender. Other news that has boosted the price of the cryptocurrency in the past include the announcement by MicroStrategy that it will buy another $ 400 million in bitcoin and statements about the increase in inflation in the United States by the Secretary of the Treasury, Janet Yellen.

However, it seems that these events have not increased the demand for Bitcoin as a hedging instrument, as has happened in the past. Glassnode charts suggest that institutional demand has lost momentum lately. As analyst William Clemente observes, the trend since February had been to withdraw coins from Coinbase (the institution’s favorite exchange house) to personal custody. Since the end of May, this trend has been reversed.

Clemente supports his thesis by pointing out that the number of whales, that is, the addresses with possession of more than a thousand bitcoins, has been decreasing, after having reached a maximum in February. This is confirmed by revelations such as those recently made by the investment fund Ruffer, who released billion-dollar profits after progressively selling the bitcoins they acquired just five months ago.

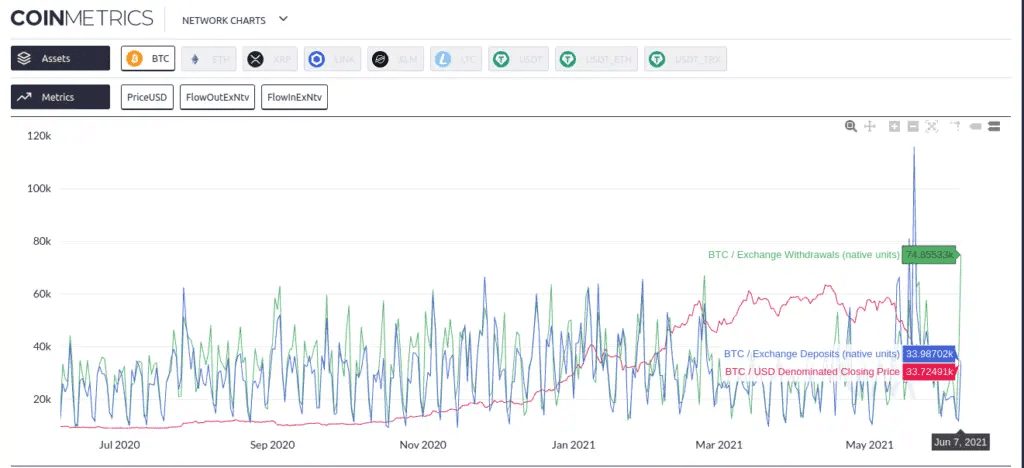

But what is reflected in Coinbase does not seem to correspond to other bitcoin exchanges. According to Coin Metrics graphs, just yesterday the second highest peak in a year of withdrawals from exchange houses to personal wallets was reached, which is usually a sign of accumulation by investors. It seems that many made their purchases in the recent fall and would be guarding their currencies in anticipation of a new bull run.

The battle between bears and bulls continues in the Bitcoin market. While there is an evident decline in demand, the sign of accumulation in personal wallets could suggest that bitcoin is close to bottoming out.